Tuesday, September 14, 2010

Friday, March 12, 2010

Looking for a “bank owned” home this weekend?

Monday, January 25, 2010

Roadblocks in the way of a Healthy Market

{true}

Pam Truex

Truly committed to excellence.

Max Broock

275 S. Old Woodward

Birmingham, MI 48009

Dear Homeowners,

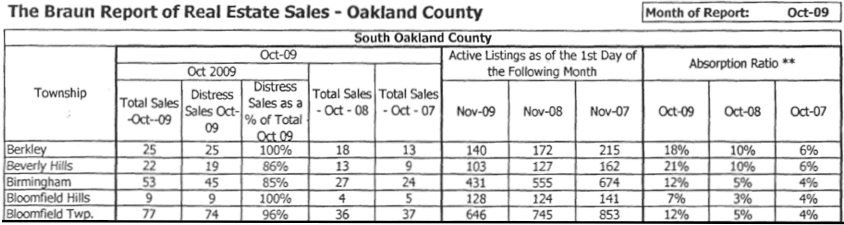

The two biggest roadblocks to get our market back on track are the competition from the foreclosures, many at absurdly low prices, and the imbalance of supply to demand. The number of foreclosures in the active listing inventory in counties around the country around the country are extremely high. Until there are virtually no more foreclosures to be sold, they will continue to pollute our markets as buyers set these prices as their expectations of the value for the neighborhoods where they are located. Our realtor community is the only source of resolution to this problem. They assist sellers to focus on getting their homes listed and sold at current market value. These sales will then be “so far back in the rear view mirror,” that they will no longer be in the pool of comparables which the appraisers must use...which often corrupts transactions on the (non-foreclosure) properties.

Pam Truex

Monday, January 18, 2010

Changes in the foreclosure market we foresee for 2010.

Changes in the foreclosure market we foresee for 2010.

we foresee for 2010.

By Rick Sharga

Senior Vice President, RealtyTrac Inc.

Overall, we expect an ample supply of discounted foreclosures to be available in 2010, but pent-up demand and record-low cost of ownership will ensure the best deals will be snatched up quickly by well-prepared bargain hunters. Most local markets won’t experience a double-dip in home prices during the year, but the prime buying conditions in place now may be gone by year’s end.

It’s likely that we’ll set a new record in terms of overall foreclosure activity for the fourth consecutive year. Over 1.3 million U.S. households received a foreclosure notice in 2007; over 2.3 million received notices in 2008; and although the 2009 numbers haven’t been completely counted at the writing of this article, there will be somewhere in the vicinity of 2.8 to 3 million households in foreclosure. We’re likely to see more than this in 2010, with the number of homeowners in foreclosure probably exceeding 3.5 million, before the trend begins to reverse itself sometime in 2011.